In September, Deft Research published its fifth annual study on the perspectives and attitudes of group health benefit managers at small to mid-sized U.S. firms titled, Group Health Benefit Decision-Makers Study. According to the study’s 553 respondents, offering health benefits remains an important part of employers’ overall human resource strategy. Very few firms are considering completely doing away with health benefits.

Small employers have experienced tolerable premium increases in the past few years, leaving many content with their situation for now. But, the study found that employers’ commitment to offering health benefits combined with their lack of resources to really study the issues surrounding health insurance, leaves them wanting new cost-control strategies, but unable to implement them.

Any carrier that streamlines and supports changes that take employers toward innovative benefit designs could unleash considerable pent up demand.

Key Finding - New Strategies Considered More Often

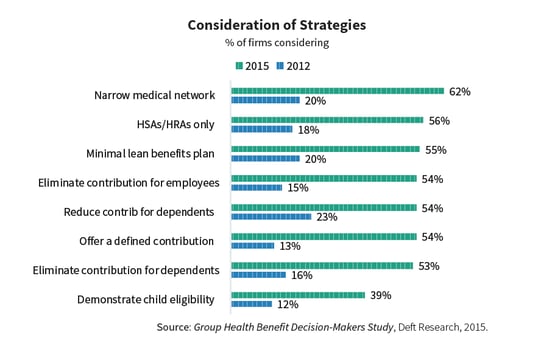

For many employers, and for many years, the only cost control strategies have been to either increase deductibles or shift more of the premium increase to employees. Even at their most brilliant, strategies don’t work forever. And, pulling on this same set of levers year after year is becoming untenable for employers and their employees. These are the reasons for a dramatic increase in the number of cost sharing strategies currently under consideration.

Narrow Networks Take the Lead

Sitting at the top of the list above, as a prime example of the small group market’s status, are narrow networks. Over the past four years, from 2012 to 2015, narrow networks have moved from being rarely considered to being often considered. But, only 13% of employers surveyed have actually implemented the use of narrow networks as a cost control strategy.

In fact, despite great growth in interest, none of the strategies in the chart are common. The most implemented strategy is requiring employees to demonstrate child eligibility, which has been adopted by 23% of the employers surveyed.

Demand Increases for New Solutions

The four years represented in the chart is a fairly long time. It has been enough time for narrow networks and other cost-saving strategies to have percolated down to small employers. But, according to the study, small employers do not necessarily thank their agents for their new-found knowledge. Respondents indicated that they were “extremely satisfied” with their agent’s presentation of options only 15% of the time. Regarding the options brought to them, the majority of employers are “moderately satisfied” or less satisfied than that.

"For employers, benefit presentations that include new solutions spur higher ratings of their agents. When employers felt their agent had recommended creative solutions, their ratings of their agent jumped to 60% extremely satisfied."

One problem may be that as service requirements pile up, agents’ businesses are stressed. The study shows that agents are asked to perform many functions beyond simply selling group health insurance. For example, it is more common now than it was 4 years ago for agents to help employers assure their benefits and reporting are in compliance with the law.

Coming around to narrow networks again, this is a new strategy that has been difficult for agents to adopt as a regular offering to their clients. The narrow network requires a new set of information and a new presentation. It creates doubt about access to care, and many points of skepticism that must be addressed. For agents, it is easier to skip it and renew the existing plan.

More Changes Ahead

Small employers are receptive to new ideas, but this need is not being adequately met by the existing system. The group of employers studied is not overly happy with the current services they receive from agents and a majority are aware that solutions are out there that aren’t being brought to them. If health plans took steps to remove obstacles and incentive agents to educate, promote, and sell new solutions for smaller employer groups, new opportunities to take market share would follow.

For several years, health plans have been able to deliver moderate premium increases, but even with this success, increases are still above inflation. As higher inflation threatens again, changes are demanded, and the idea of switching carriers becomes a real need not just a distant thought. Health plans that put together agent training and support for implementing solutions, will come out ahead as dissatisfaction with the old methods pushes this employer-sponsored health market to be more dynamic.

ABOUT THE RESEARCH

Deft Research’s annual Group Health Benefit Decision-Makers Study tracks employers’ strategies and practices, and the results of their efforts to provide and manage health benefits for their workforce. The report provides a detailed look at the health benefit strategies of U.S employers at firms with 3 to 999 employees, as well as current trends in the group health insurance market.

The survey was completed by 553 employers in July of 2015, and reflects respondents’ 2014 and 2015 decisions, as well as their plans for the future. The study’s sample included employers in all major U.S industry sectors.

For more information on obtaining a copy of the full 58-page Group Health Benefit Decision-Makers Study, please email info@deftresearch.com