Attracting Age-ins is a Core Competitive Strategy

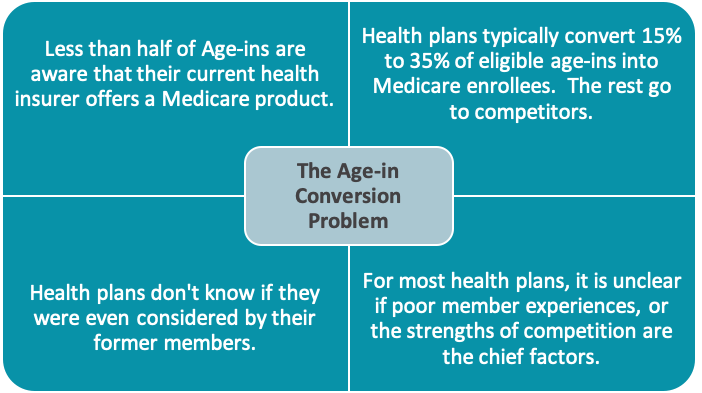

Most health plans are not satisfied with the proportion of their former commercial members who convert into Medicare members. This under-performance is called the Age-in Conversion problem. And it challenges Medicare marketers trying to enroll their own individual and employer-sponsored health plan customers.

A one-two punch.

- Age-in Conversion studies: Working with clients, Deft Research has developed a consumer survey to create measures of the key opportunities for improving age-in conversion. Our clients say survey data will help them prioritize and focus the actions they will take.

- List Scoring Algorithms: Deft Research is also uniquely positioned to address the Age-in Conversion problem with high quality list scoring algorithms.

Each part of this approach delivers its own value.

Age-in Conversion studies almost always survey a health plan’s own members – or persons of a certain age who were previously in IFM or employer plans and are no longer. The surveys identify the strengths of competition, relative brand values, and the member experience factors that influence age-in choices. Without this decision support, health plan personnel have had trouble aligning on a more positive future in which Age-in Conversion rates rise.

The list scoring algorithms enable health plans to apply market intelligence to an entire list of consumers. These scores help clients make more informed marketing decisions at the prospect level. To develop the algorithms, Deft used both primary market research and additional data. This leads to market insights specifically designed for health insurance marketing decisions.

The new 2019 algorithms produce scores for:

- Late to Medicare Score – likely to delay enrollment in Medicare past age 65.

- Prefer Medicare Advantage Score – likely to prefer Medicare Advantage plans over other options.

- Zero Dollar Premium Preference Score -- likely to prefer a Zero Dollar Premium MA plan over other MA options.

- Prefer Medicare Supplement Score -- likely to prefer Medicare Supplement plans over other options.

- High Dollar Med Supp Score – likely to prefer a high premium Medicare Supplement (greater than $200 monthly premium) over other MedSupp options.

- Respond to Direct Mail Score – likely to respond to Medicare related direct mail solicitations.

- Use an Insurance Agent Score – likely to prefer using an insurance agent or broker for advice.

When list scoring is used, insurers report higher responses to direct mail, and lower costs per sale. To accomplish a variety of goals, insurers may use algorithmic scores alone or in combination with one another.

For more information, contact us

Related Post: Propensity Scores and List Scoring