Consumers approaching age 65 – sometimes referred to as “Age-Ins” in the health insurance community – have mixed levels of confidence in their preparations for retirement. Those that feel confident they are prepared commonly have considered a greater number of potential expenses in retirement – including many costs associated with managing their healthcare needs. Recent research from Deft underscores that offering healthcare planning resources and Medicare plan education to those preparing for retirement are an important way for Commercial health insurers to build trust with future Medicare consumers.

Preparedness for Healthcare Expenses Fuel Gaps Among Age-Ins’ Confidence in Retirement Savings

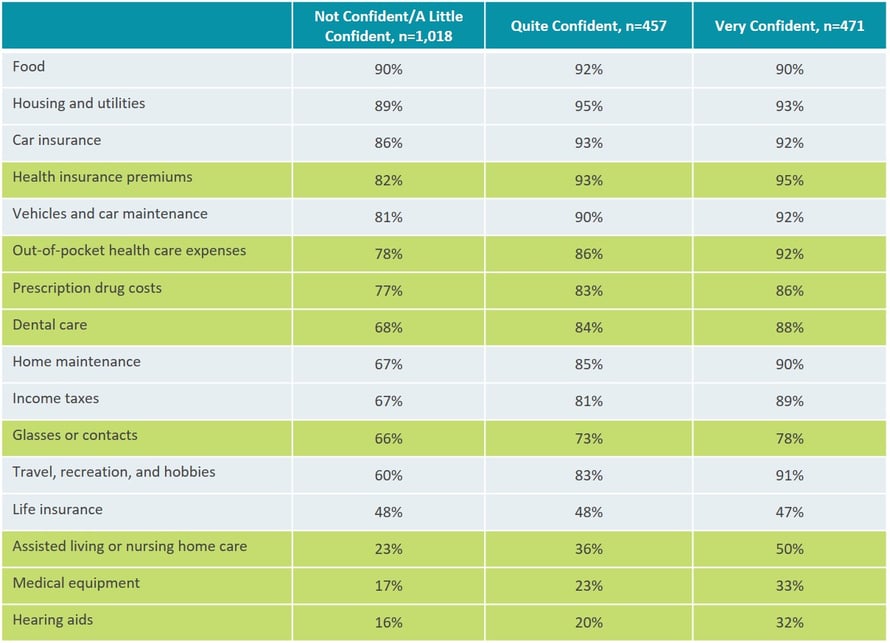

Deft Research took a close look among Medicare Age-Ins and their consideration of various expense categories in their retirement planning process, while also asking these consumers to rate their self-stated confidence in having enough money saved for retirement. The results show interesting patterns comparing consideration levels of expenses among those that are more vs. less confident in their retirement preparedness. The first takeaway is that expenses like food, housing and utilities – the basics if you will – are universally considered regardless of level of financial preparedness for retirement. However, gaps emerge quickly going down the line of expense considerations after this, including several key healthcare related expense categories.

Source: 2018 Deft Research Age-in Study

An obvious conclusion here is that increasing Age Ins’ consideration of healthcare expense categories is contingent on improving awareness and familiarity of these expenses with Age-Ins. Similarly, increasing consideration of, and thereby planning for, healthcare expenses is linked to have a halo effect on Age-Ins’ confidence they are financially prepared for retirement.

Confidence in Retirement Savings also Linked to Recognition of Current Insurer’s Medicare Offerings

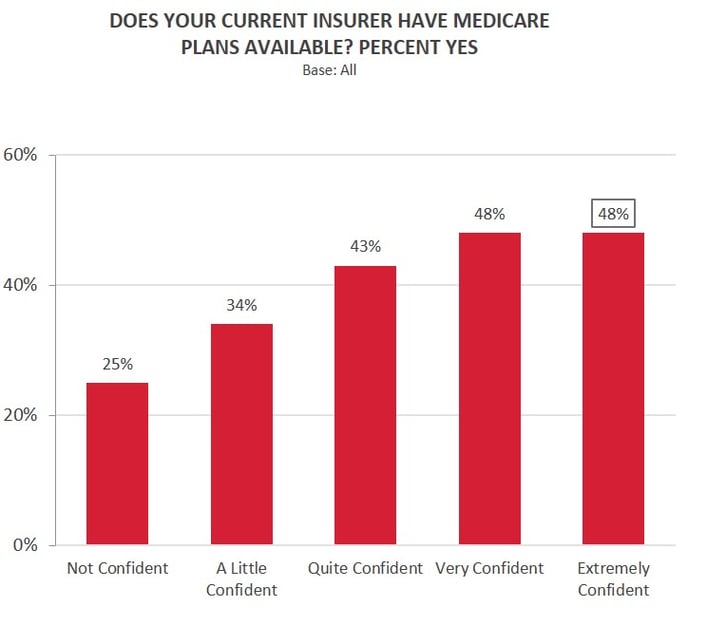

Deft’s recent research also highlights similar gaps among Age-Ins in their recognition of their current insurer’s Medicare offerings and their stated confidence in retirement savings. Segmenting Age-Ins’ by their various confidence levels in financial preparedness for retirement, there is a clear relationship between confidence in retirement savings and positive confirmation of Medicare product availability with their current Commercial insurance carrier.

Source: 2018 Deft Research Age-in Study

This suggests that those Commercial carriers able to build higher awareness of their Medicare products with their Age-In members not only have an advantage in Medicare membership conversion but also may be enjoying ancillary customer experience (CX) benefits because they are helping these members feel more confident in their retirement planning.

Big Opportunity for Health Insurers to Deliver Holistic Retirement Expense Education for Age-Ins

According to the Pew Research Center, a projected 10,000 Americans qualify for Medicare each day in our country. Health insurers have an extraordinary opportunity to help Age-Ins feel more confident about affording retirement as they approach their 65th birthday. They can do this by educating current and prospective members not only about key medical expense considerations for their retirement years, but also by putting this information in context with other important expenses to provide Age-Ins a broader picture of what needs to be considered when planning for retirement. Furthermore, health insurers should also look to actively educate their current Age-In members about their own Medicare offerings as another helpful tool to increase feelings of financial preparedness for retirement. By doing both, health insurers can build a strong, more lasting bond based on trust with future Medicare consumers.

Deft Research’s syndicated research studies provide a national benchmark for health insurance carriers to gauge the Medicare, Employer Group, and Individual markets. Health insurers that are interested in surveying their own members and prospects engage Deft Research in custom research studies to provide insight for their marketing and product strategies. Contact Deft Research with any questions you may have regarding syndicated and custom research needs.