Watch AEP Deep Dive: Analytics to Action to hear an analysis of Medicare AEP shopping and enrollment data.

In the webinar, Deft Research and Connecture’s expert panel discuss final numbers and trends from AEP, along with new research on shopping and engagement preferences among Medicare members, including older baby boomers and the age-in population.

The expert panel includes:

- George Dippel, SVP of Client Services, Deft Research: For almost eight years, George has worked with Deft Research, the leading quantitative market research firm for the health insurance industry. During that time, he has helped position Deft as a trusted research partner for over 110 clients, including health insurance plans, PBMs and governmental bodies.

- Peter Urbain, SVP of Product, Connecture: Peter has more than a decade of executive leadership experience in the healthcare industry. Prior to Connecture, Peter worked with powerhouses Healthgrades, Merge Healthcare and IBM.

- Christopher Neuharth, VP of Product Strategy & Design, Connecture: Christopher has nearly 15 years of experience in user experience design and management, and has led significant ongoing research into how Americans purchase health insurance.

- Matthew Leonard, Director of Medicare, Connecture: Matt has spent over 15 years working in the Medicare space with insurance carriers in the Midwest. During this time, he helped launch Medicare Advantage Plans, Medicare Select, Part D and Med Supp plans in various states.

A key Connecture finding is “An 82% improvement in the enrollment-conversion rate among Medicare beneficiaries using online pharmacy-drug tools, compared to beneficiaries who did not leverage such resources.” Thinkadvisor highlighted some of these findings. Connecture’s online shoppers were likely to consider plans’ coverage for Eliquis and Xarelto, two drugs used to reduce blood clot risk; Proair HFA, a drug used to treat shortness of breath; and Lantus Solostar INJ, a drug used to treat diabetes.

Among the Deft Research findings, 15% of seniors are undecided at the beginning of the AEP. Of those, about one quarter wind up switching. The remaining 85% who made a decision at the beginning of the AEP remained with their early indication. Market stability over the last five years has given Medicare members little reason to switch.

The low AEP switch rate gives health insurers more reason to increase their efforts on Age-In campaigns. This is a dynamic group and the Boomers represent a large population to tap into. It's critical to reach Age-Ins at the time they’re considering enrollment which may not be at age 64.

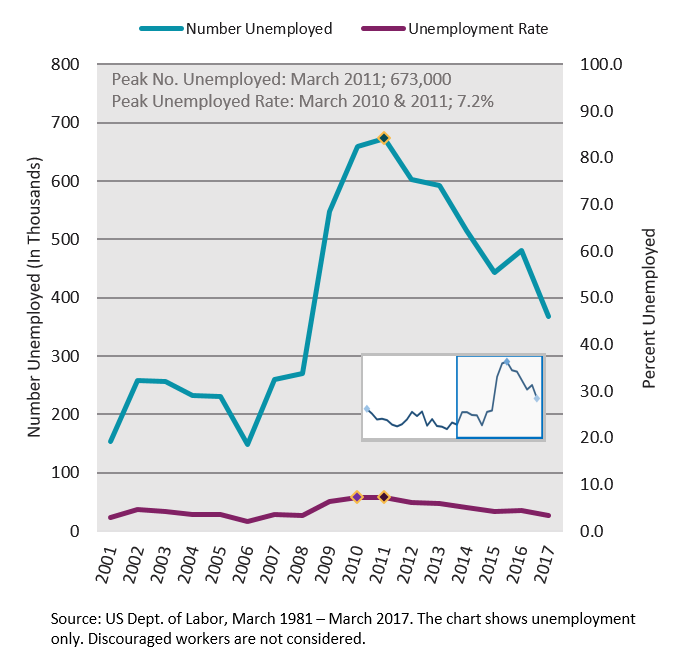

One key factor to consider in an Age-In campaign is that seniors are delaying enrollment in Medicare. Low unemployment may be one driver of this. There has been declining unemployment for 60-64 year-olds since 2011.

Unemployment, Age 60-64 (in thousands)

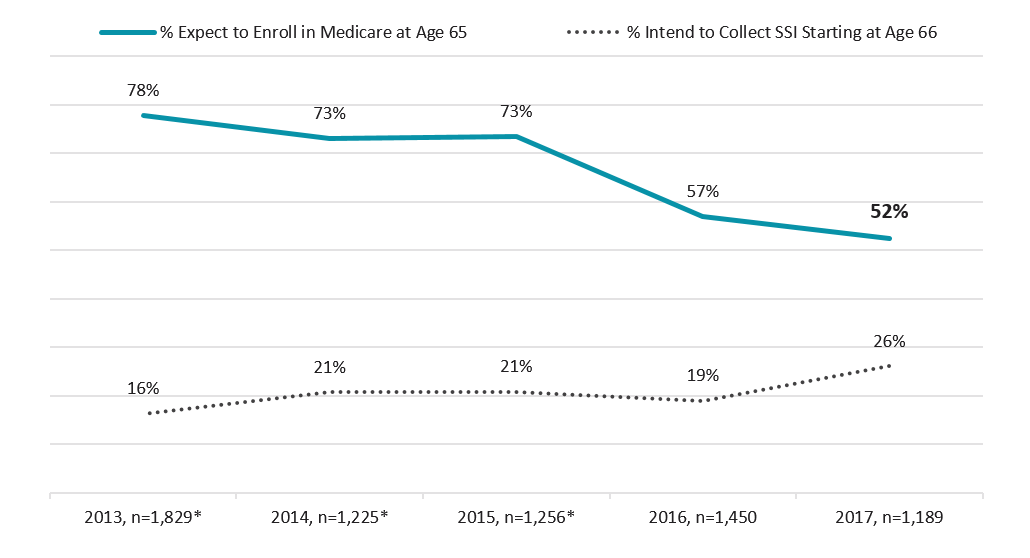

Percent Expecting To Enroll In Medicare At Initial Age 65 Eligibility

Base: Age-Ins

*64-year-olds only. Excludes 65-year-olds within three months of having become eligible for Medicare.

Do you plan on switching your health insurance to Medicare when you turn 65?

At which age do you plan to start taking (or did you start taking) Social Security benefits?

The low switch rate during AEP is putting more pressure on Health Insurer Age-In campaigns. Targeting Medicare prospects when they’re most likely to enroll is more complex than just targeting 64 year olds. Another way to improve the Age-In campaign response is to take advantage of brand equity and make efforts to build awareness of your Medicare plans with your current Commercial plan members. Even if the Commercial members are aware of your Medicare plan, educating them on the specifics may reap greater benefits.